Key Takeaways

- Fee structures directly influence the dynamics and transparency of adviser-client relationships.

- Understanding various models helps clients make more informed, value-driven choices.

- Trends show a growing preference for clarity and flexibility in compensation.

- Regulatory oversight is essential, but it does not guarantee improved client outcomes.

- Personal needs and goals should dictate the ideal adviser fee structure.

Table of Contents

- Introduction

- Common Fee Structures

- Impact on Adviser-Client Relationship

- Trends in Adviser Compensation

- Client Preferences and Satisfaction

- Regulatory Considerations

- Choosing the Right Fee Structure for You

- Conclusion

Selecting the right financial adviser is foundational for achieving your long-term financial goals. One crucial—but often overlooked—factor is how advisers are compensated. Whether you are focused on retirement planning, wealth management, or investment strategies, the fee structure your adviser uses can directly influence the quality of advice you receive and the alignment of their interests with yours. For those seeking truly independent guidance, understanding how fiduciary services are paid is especially important.

Fee structures are more than just numbers—they shape the adviser-client relationship, affecting trust, expectations, and overall satisfaction. The trend toward greater transparency in the financial advisory industry empowers investors to ask the right questions about how they are paying for services and what value they can expect in return.

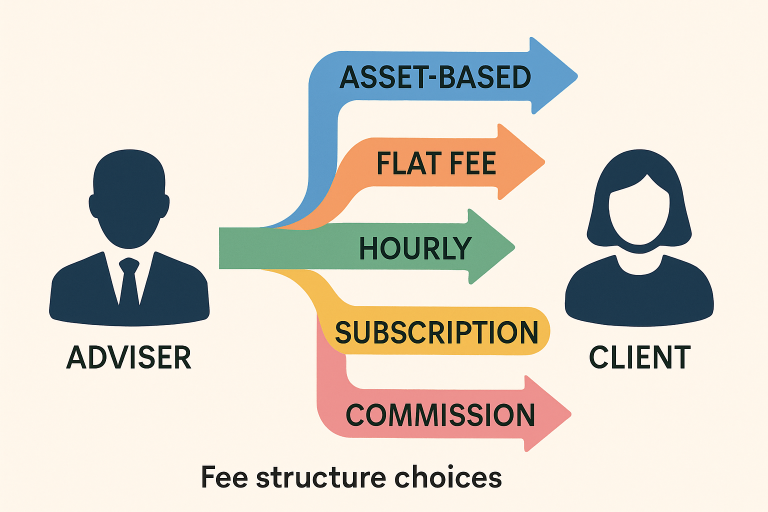

With financial products and advisory models constantly evolving, consumers now face a wider array of fee options than ever before. Each approach—whether asset-based pricing, flat fees, or commission arrangements—comes with its own advantages and considerations. Understanding these frameworks is key to fostering an equitable and productive relationship with your adviser. An optimal fee structure not only aligns with your financial situation but also reflects the adviser’s commitment to transparent, client-focused guidance. Prioritizing clarity and fair compensation lays the foundation for a strong, constructive partnership and confident financial decision-making.

Common Fee Structures

Most financial advisers adopt one or a combination of well-established fee models, each tailored to different client needs and expectations:

- Asset-Based Fees: This popular structure charges a percentage—typically around 1%—of the client’s assets under management. The model can incentivize the adviser to help clients grow their portfolios, but it may not always scale with the extent of service required.

- Flat Fees: Clients pay a fixed amount for a specific engagement, like developing a holistic financial plan. This approach minimizes surprises and works well for projects with a defined scope.

- Hourly Rates: Advisers charge between $200 and $500 by the hour. This structure suits clients who need targeted guidance instead of ongoing management.

- Subscription Fees: Predictable monthly or annual payments provide ongoing support and access to adviser expertise. The model suits clients who benefit from regular check-ins and continuous advice.

- Commission-Based: Here, advisers earn revenue by selling investment or insurance products. While this structure may reduce the client’s upfront cost, it introduces the risk of biased recommendations prioritizing adviser compensation.

Impact on Adviser-Client Relationship

The chosen compensation method shapes the entire dynamic between adviser and client. Structures clearly defining what you’re paying for, such as flat and hourly fees, often foster stronger mutual trust since costs and deliverables are transparent. Subscription models can maximize the value proposition by offering regular support and advice tailored to ongoing changes in the client’s circumstances. However, commission-based compensation can create conflicts of interest, incentivizing advisers to prescribe unnecessary or ill-suited products. For this reason, understanding potential bias is essential when evaluating how a particular fee structure may impact the objectivity of the advice.

Transparency and Trust

Upfront discussions of fees are essential for a lasting, trust-based relationship. Clients consistently report higher satisfaction when they understand exactly how—and why—they’re being charged. This clarity also encourages advisers to remain accountable and client-focused.

Trends in Adviser Compensation

There’s a noticeable shift across the industry toward more transparent and flexible fee models. According to a recent study, 92% of advisers use asset-based fees, while interest in flat-fee models is growing. The proportion of commission-only advisers is decreasing, reflecting consumer demand for impartial guidance and clear value propositions. These trends highlight a burgeoning focus on trust, objectivity, and value-driven engagement. Relatedly, many advisers are adopting modular or à la carte service offerings. This hybrid approach lets clients tailor the type—and cost—of advice to their specific financial situations, further reducing barriers to engagement for a broader spectrum of investors.

Client Preferences and Satisfaction

Survey data illustrate that clients are largely satisfied when they understand the fees they incur and feel they’re getting appropriate value. Recent research suggests that 85% of clients know how much they’re paying, and 76% believe they’re getting good value. These insights stress the importance of adviser transparency and ongoing communication about the cost-benefit relationship. Fee structures aren’t purely transactional—they shape the service quality, adviser incentives, and client peace of mind. By openly discussing compensation, advisers and clients can ensure that expectations are aligned, minimizing misunderstandings and maximizing satisfaction.

Regulatory Considerations

Regulators play a critical role in shaping adviser compensation to protect consumers from abusive or deceptive practices. However, recent academic research notes that limiting adviser fees through regulation doesn’t always translate to better client outcomes. Advisers may alter the quality of service or the information they offer to offset fee restrictions. Consequently, regulatory solutions are part of the broader conversation about fairness, transparency, and client autonomy in adviser relationships.

Choosing the Right Fee Structure for You

Selecting an adviser’s compensation model should begin with a clear understanding of your needs. Outline the level and intensity of financial support you require, then educate yourself about the advantages and challenges of each fee structure described above.

Assess Your Needs: Identify whether you need comprehensive, ongoing support or strategic, project-based advice.

Understand Fee Models: Learn about each fee type and how it affects the adviser’s approach and your costs.

Evaluate Transparency: Look for advisers who are upfront about their pricing and any conflicts of interest.

Compare Options: Before making a commitment, consult with several advisers and ask for detailed breakdowns of services and associated costs.

By carefully weighing these steps, you can ensure that your choice supports your financial well-being and your confidence in the adviser’s guidance.

Conclusion

The structure by which financial advisers are compensated is a pivotal factor in forging a positive, transparent, and productive relationship. By understanding the nuances of different fee models, staying motivated to seek clarity, and selecting advisers who share your values on transparency and service, you empower yourself as a client. These insights ensure that you’ll build wealth and a trusted advisory partnership designed to last.